U.S. Fed moves to aid recovery

The U.S. Federal Reserve on Tuesday decided to keep its key interest rate unchanged at a record low of between zero to 0.25 percent, and promised to buy more Treasury securities to prop up the economy.

|

|

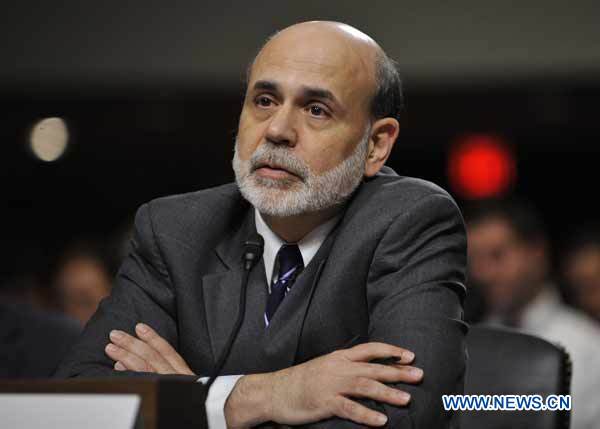

U.S. Federal Reserve Chairman Ben Bernanke testifies before the Senate Banking, Housing and Urban Affairs Committee during a hearing on the Federal Reserve's semiannual monetary policy report to the Congress on Capitol Hill in Washington D.C., capital of the United States, July 21, 2010. [Zhang Jun/Xinhua] |

"The pace of recovery in output and employment has slowed in recent months," the Federal Open Market Committee, the Fed's rate- setting body, said in a statement after concluding a one-day regular policy meeting.

This represented a clear shift from what the Fed viewed the economy more than a month ago, when it said the economic recovery was "proceeding" and the labor market was "improving gradually."

The Fed maintained its rhetoric in terms of future direction of its rate policy, saying the Fed "continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

The Fed took a small step forward in stimulating the anemic economic recovery by promising to "keep constant the Federal Reserve's holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities (MBS) in longer-term Treasury securities."

Beginning at the peak of the financial crisis in November 2008 and then increasing in March 2009, the Fed announced and began buying large quantities of MBS that were guaranteed by the housing agencies, including Fannie Mae, Freddie Mac, and Ginnie Mae. The Fed also bought some of the debt of those agencies and also bought some longer-term Treasury bonds.

But currently, repayments of principal from agency debt and MBS are not being reinvested, allowing the holdings of those securities to run off as the repayments are received, in an effort to gradually normalize the Fed's balance sheet, which currently stands at around 2.3 trillion dollars.

The shift in the Fed's viewpoints and policies came from a host of economic reports which suggested further slowdown in the economic recovery.

U.S. economy grew at a 2.4 percent annual rate in the second quarter of this year, a deceleration from an increase of 3.7 percent in the first quarter of 2010 and 5.0 percent in the last three months of 2009, according to the preliminary estimate by the Commerce Department.

In addition, U.S. unemployment rate stayed flat at 9.5 percent in July, but nonfarm payroll employment declined by 131,000, further evidence of weakness in the job market, the Labor Department reported on Friday.

0

0