China's RMB devaluation will aid the world economy

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, August 13, 2015

E-mail China.org.cn, August 13, 2015

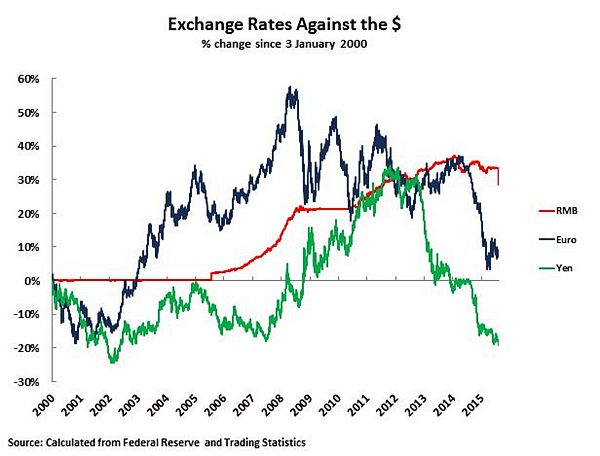

Japan's quantitative easing (QE) under "Abenomics" created severe yen devaluation. Figure 2 shows the yen devalued against the dollar by 30 percent after Abe became prime minister in September 2012.

The Eurozone, faced with economic stagnation and Greece's financial crisis, launched QE leading to a Euro devaluation of 26 percent since the beginning of 2014.

Japan and the Eurozone therefore both pursued policies attempting to make their exports more price competitive and imports sharply less competitive - negative policies for other countries.

Figure 2

The U.S. did not pursue currency devaluation - the dollar rose sharply as the yen and Euro fell. But the U.S. is increasingly concerned by a domestic asset bubble economy after years of QE and virtually zero interest rates. To try to choke these off the Federal Reserve officially indicated it would like to raise interest rates this year - despite low inflation, low wage increases and relatively slow U.S. growth.

However, as most other economies currently have low interest rates to stimulate growth, the consequences of a U.S. interest rate rise are clear - it would suck capital out of the rest of the world. Christine Lagarde, managing director of the IMF, publicly appealed for the Federal Reserve not to act this year, only to be told the Federal Reserve would be guided by U.S. domestic needs not global ones.

The advanced economies therefore remained locked in slow growth but each running internationally destabilizing policies - Japan and the EU pursuing "currency wars" and the U.S. offering the threat of a globally destabilizing interest rate rises.

The best way out of this situation would be coordinated international action. China proposed this at the G20 and in the July speech by Premier Li Keqiang to the OECD. One of China's most well connected economists, former World Bank Vice President Justin Yifu Lin, has promoted an integrated global economic recovery plan based on China, and other capital-rich economies, financing large scale infrastructure investment in developing countries - simultaneously stimulating their growth and export markets for the sophisticated capital equipment primarily produced by developed economies. China has taken a regional initiative by creating the Asian Infrastructure Investment Bank, but the advanced economies have refused coordinated action globally.