Government debt and urbanization

- By Mike Bastin

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, July 31, 2013

E-mail China Daily, July 31, 2013

The State Council, China's cabinet, has directed the National Audit Office to audit all local government debt accounts, reflecting the rising concern over debt levels amid the economic slowdown. Of late, disappointing trade figures, combined with lower than expected second quarter GDP figures, have increased the pressure on the central government to introduce some sort of financial stimulus package to boost the economy.

|

|

|

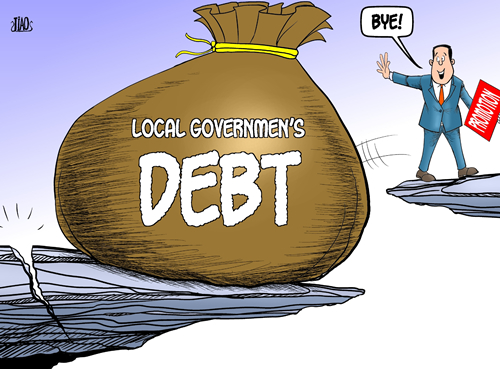

[By Jiao Haiyang/China.org.cn] |

Many experts, however, are warning against any such stimulus for the urbanization drive. The problem is local governments' debts, which have been in the news ever since the central government announced a 4-trillion-yuan ($652-billion) stimulus package in 2008 to overcome the shocks of the global financial crisis. In fact, the experts say it's the stimulus that helped create this mountain of debt.

According to official data, local government debts today exceed 12 trillion yuan, although ratings agency Fitcsh suggests the figure could be as high as 13 trillion yuan, or a quarter of China's GDP.

Fears that fresh, and perhaps substantial, funds (or rather loans) from the central to the local governments will add to this mountain of debt are well founded. But local governments' reckless lending and profligate spending alone cannot be blamed for the problem.

Changes in the tax laws in 1994 forced local governments to depend on areas other than taxation as their main source of revenue. And they found land (or the transfer of land-use rights) a convenient and lucrative alternative. Since local governments cannot depend on income from taxation, one can understand their desperation to seize the opportunity offered by land.

But with local government debts threatening to turn into a national debt crisis, the central government has to either exercise tighter control or change its funding pattern. The central government has to take immediate measures to rein in excessive local government spending and enforce austere spending limits. For instance, it can impose severe financial penalties on local governments that cross their spending limit. In this regard, China could learn from the United Kingdom where local government finances are strictly managed.

To prevent the recurrence of such humungous local government debt in the long term, the central government should review the nature of urbanization and determine whether spending and debt are vital ingredients of urbanization.

The key to any sustainable economic development program, with or without urbanization at its core, is planning even for the distant future, which is not the case with China now.

Urbanization is central to China's economic future but it should follow at a far more modest, gradual pace. The funding and spending worries will recede once this is made clear by the central government - and is accepted by all.

Any debate on urbanization should segment China's vast territory in regions according to their level of urbanization/modernization and need for further urbanization. Following the example of the special economic zones (SEZs), the central government could now think of establishing a few "special urbanization zones" (SUZs). For funds, it could work closely with the private sector and provide good enough incentives to attract foreign direct investment (FDI). Till date, 80 percent of all FDIs in China has flown into the eastern coastal provinces, not far from the SEZs. Maybe it's time to direct some of it toward SUZs.

This, however, does not mean the local governments will lose their importance. They still have a crucial role to play in SUZs despite the funding and spending being channeled through the central government and sourced from the private sector. The local governments, or rather those that are part of the initial SUZs, will be best placed to direct and coordinate investment most effectively. But while doing so they have to keep longer-term societal benefits in mind and forget about making short-term gains.

Many would justifiably argue that the SUZs, no matter how many in the initial stage, should be close to China's first-tier cities and/or SEZs. But such is the economic gap between East and West, and urban and rural China that there is a real danger that it may never be bridged. Such a divide may prevent future "trickle-down" effects from spreading across China.

Therefore, the SUZs, maybe four initially, should be in North and West (or Southwest) China and as geographically apart as possible from each other. SEZs and East China were the sine qua non of China's economic emergence. Perhaps it is time for SUZs and West China to take the country through the next phase.

The author is a researcher at Nottingham University's School of Contemporary Chinese Studies and visiting professor at China's University of International Business and Economics.