Pension gap exerts severe pressure

- By Ma Jun

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, December 12, 2012

E-mail China Daily, December 12, 2012

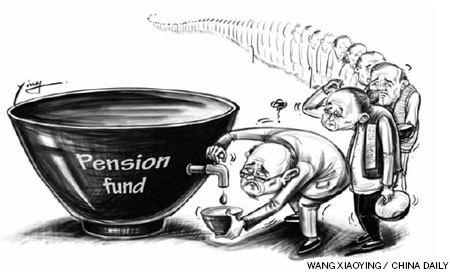

China's colossal pension gap is expected to greatly increase its fiscal pressure and government debt risk because it faces an ever-increasing aging population.

If the country doesn't undertake necessary reforms, the shortage in pension for urban employees over the next 38 years would be an estimated 83 percent of its 2011 GDP. If rural residents are counted in, the government will face much greater fiscal pressure to bridge the big pension gap. Under the current pension system, three working people support one retiree, but this ratio is likely to change to 1:1 by 2050.

The drastic increase in medical expenses for outpatients, hospitalization, epidemic prevention, medical management and long-term nursing services provided for senior citizens will be another source of fiscal pressure and government debt risk for the government.

It is estimated that such medical expenses now account for 5 percent of China's GDP, but the percentage will rise to 10, of which one-third has to be borne by the government. The increased medical expenditures in these fields over the next 38 years are expected to be 45 percent of the country's 2011 GDP.

The ever-rising medical expenses, together with the enormous pension payment, the cost of environmental protection and the huge debts held by local governments, will push listed government debt to more than 100 percent of China's GDP by 2050 if no reform is undertaken. This should be a reminder to the government that, in the absence of precautionary reforms, the possibility of a Europe- and United States-style debt crisis in China cannot be ruled out.

Therefore, to avoid a long-term debt crisis, the government has to carry out a series of reforms in the coming years, for which the following decade offers a golden opportunity.

With the acceleration of urbanization and the participation of an increasing number of people in the national social security network, China's pension shortage in the following years will not increase at a swift pace and thus the government will not face too heavy a fiscal pressure. That should offer the government some space to press forward sweeping reforms.

However, with the gradual decline in the number of people being added to the national security network, China's pension gap and fiscal pressure will rise rapidly, which will undermine the government's fiscal capability to push ahead some powerful reformatory measures.

As a way of easing the ever-growing pressure of its yawning pension gap, China should start to gradually extend the current retirement age of employees. For example, it can extend the retirement age of men by four years and women by nine years. The measure will help reduce the country's pension shortage in the future, although it cannot offer a once-and-for-all solution.

China should also allocate part of the government-held shares of listed State-owned enterprises to the national social security network to enable the dividends and interests they yield to become an important source of social security payment. This, together with a longer working age, will fill the pension gap for urban residents in the future.

Considering some practical difficulties in using SOEs' shares as national social security fund, the government can take experimental measures in the coming years. For example, it can first use about 20-30 percent of its SOEs' shares, which would be about 3 trillion yuan ($481.56 billion), as national social security fund within two or three years and then gradually expand the scale after gathering some experience from the process.

Besides, it should establish a long-term nursing insurance system to ease the fiscal pressure in this field. Experiences of the US, Germany, Japan and the Republic of Korea show that the establishment of a commercial nursing insurance system can help mitigate a country's long-term nursing expenses, which now are a heavy fiscal burden both on households and the government.

The government should also take practical measures to accelerate the opening of the country's capital accounts and push forward the internationalization of the yuan.

China's current foreign assets are mainly dominated by foreign reserves, with a low return ratio, which is about 2 percent. In contrast, as a major form of China's national debt, inbound foreign direct investments usually yield 10 percent returns. To change such asymmetrical return ratio between its foreign assets and debts, the government should lower the share of foreign reserves in its foreign assets and raise the ratio of non-governmental investment by a large margin.

As a precondition to expanding outbound non-government investment, it has to first open its capital accounts. The country's foreign assets, at present, are mainly in dollar and euro denominations, which could pose a huge risk to its foreign assets in times of drastic fluctuations of the two currencies.

To reduce such a risk, China should try to keep some of its foreign assets in yuan. As a concrete move, the country should open its Panda bond market and allow foreign financial institutions to issue yuan bonds in the domestic inter-bank bond market and domestic investors to hold more yuan-denominated foreign assets.

The author is chief economist of Deutsche Bank Greater China and a researcher at Boyuan Foundation. The article is an excerpt from a speech he delivered recently.