Trade growth slow as economy shifts

- By Zhang Lijuan

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, May 25, 2012

E-mail China.org.cn, May 25, 2012

The most recent data released by the Chinese government showing a slowdown in the country's trade volume is not a surprise. Both domestic policy initiatives and international market factors have contributed to this trade downturn.

|

|

|

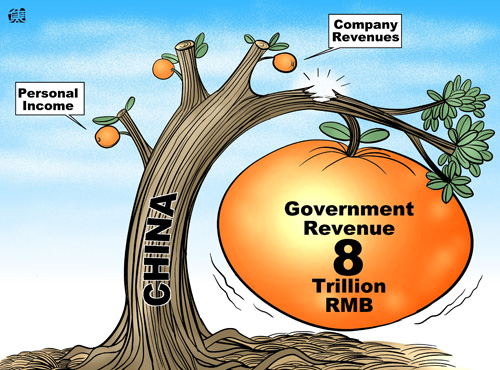

Wealthy nation? [By Jiao Haiyang/China.org.cn] |

First, China's policy to slowdown its economy mattered. It is fair to say that China needs a healthy economy, not just a fast growing one. Therefore, since the beginning of this year, the Chinese government began to shift its growth model from one driven by GDP figures to one driven by quality. This shift is good for China in the long run but will inevitably lead to balance sheet numbers not too pleasing to the eye.

Second, weaker demand from both international and domestic market was also a serious factor. The EU's trade deficit with China declined. And unfortunately, the U.S. trade growth with China was moderate. To make things worse, China's domestic demand was weak. With a higher inflation rate and an unpredictable housing market, consumer confidence in China slipped too. Furthermore, if Chinese consumers are uncertain about the future of their social safety net, they will withhold spending. All of these factors have huge effects on international trade.

Third, the prevailing exchange rate can be an effective macroeconomic policy tool. However, the Chinese financial markets are relatively closed off. Its foreign exchange regime is not market-oriented. So the appreciation of the RMB exchange rate has been less effective as an import stimulus, but more effective as an export restraint. To what extent that RMB exchange rate will impact China's trade balance going forward remains to be seen.

It is worth mentioning that China's trade with emerging markets has recently been showing faster growth. While the U.S.-China trade data exhibit more moderate growth than the same period last year, China's trade with Russia and Brazil grew faster. New emerging markets are creating larger trade growth numbers with China than China's traditional trading partners such as the U.S. and Europe. If the EU continues to suffer from its debt crisis and the U.S. economy keeps recovering at a slow pace, the landscape of China's trading relationship with the rest of the world may gradually alter.

Slowing trade growth does not necessarily mean that China's economy will slow down precipitously. In fact, the first quarter GDP growth of 8.1 percent is still a relatively high growth rate. The most recently released research by the Chinese Academy of Social Sciences predicts that China's economic growth will be 8.5 and 9.0 percent in 2012, which is well beyond the government's stated target of 7.5 percent. The fact is local governments are unlikely to see any slowdown in their perspective regional economic growth rates. If so, with a further loosen monetary policy from the central bank, China's economic growth may not drop to 7.5 percent.

For China's trade growth, the challenges are obvious. The government will have to think over the pace of RMB's appreciation. The exchange rate is a double-edged sword for the Chinese economy. Faster appreciation may well serve China's international political and economic goals, but it may also put more "Made in China" factories and processing facility at risk.

Another policy implication of a trade slowdown is China's processing trade may lose its advantages with respect to trade creation. China has to shift its trade strategy from creating trade with cheaper labor and resource to being a part of the world's value-added supply chain. And with big challenges with respect to environmental issues and labor standards, China has to seek a realistic path toward sustainable development with full consideration for a viable social safety net, job creation, respectable labor standards, environmental protection and economic growth.

Reading China's trade data is easy, but looking into and deciphering its meanings can be very difficult. Staying away from the arguments of whether China's statistics are reliable or not, China has to face the reality of the new world economic and political dynamics. It is certain that China's trade growth will slow down as its economy does. However, while China's economic slowdown is in the government's hands, uncertainty lies in the trade slowdown which is more likely up to the global market.

Today, the U.S. and many other countries have implemented bilateral and regional Free Trade Agreements (FTAs) as an efficient way to pursue trade growth. Although China has established or is negotiating several regional FTAs, it is still playing catch-up. FTAs can ensure China's trade advantages and improve overseas market access for "Made in China" goods. It is time to improve China's trade competitiveness at the national strategic level instead of continuing to attempt to extend the heretofore export driven model.

The author is a columnist with China.org.cn. For more information please visit: http://www.ccgp-fushun.com/opinion/zhanglijuan.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.