Looking for a silver lining in cloud over property

0 Comment(s)

0 Comment(s) Print

Print E-mail Shanghai Daily, March 23, 2012

E-mail Shanghai Daily, March 23, 2012

One of the biggest questions for investors in China right now is which direction the country's property market will take in 2012. The sector directly accounts for about 10 percent of China's GDP, has a major impact on a range of industries from steel production to appliance sales, and is a major source of jobs and provides funding to local governments through land sales.

|

|

|

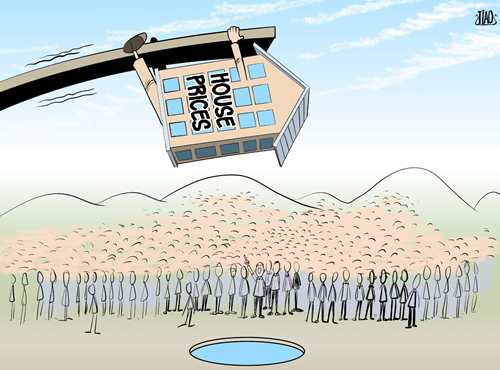

Risky business [By Jiao Haiyang/China.org.cn] |

The Chinese government has been attempting to curb growth in the property market since 2010 due to worries a speculative bubble was forming and the economy was overheating. However, with external issues affecting trade growth, concerns have tipped back the other way over the past few months.

Growth in China's economy is slowing, as Premier Wen Jiabao confirmed when he set the country's 2012 growth target at a seven-year low of 7.5 percent, and analysts have begun to look for signs of relaxing of restrictive housing policies as a way China might look to avoid a wider slowdown. News of funding challenges for local financing platforms and worries about how a drop in home prices might affect the loan quality at Chinese banks have also fueled speculation restrictions might be loosened.

No loosening

Data from the National Bureau of Statistics showed home prices in February were flat or down month-on-month in 66 of the 70 cities tracked, while there is a big inventory of unsold homes in Shanghai and Beijing.

Despite the slowdown, Chinese officials have said restrictive policies will not be loosened. Cities that have attempted to loosen restrictions have had to quickly recant under pressure from the central government.

Homebuyers and stock market investors alike appear to believe the market may have at least temporarily bottomed out. Home transaction volume for China's largest developer China Vanke rose 31.5 percent in February, and other developers recorded similar gains.

In the capital markets, the CSI 300 Real Estate Index was up 11.7 percent for the year through yesterday, outperforming the benchmark CSI 300 Index, which rose 10.1 percent over the same period.

The consensus among analysts at local investment banks covering China's property sector is that the market has bottomed in the short term, though none predicts a rapid gain in prices.

Analysts see monetary easing as the biggest positive for the sector, which includes recent and expected further cuts in the reserve requirement ratio for banks, as well as looser restrictions on loans to the property sector.

Market observers also argue that continuing declines in prices mean things can't get any worse on the policy front. Strong transactions volumes are also taken as a positive sign that demand remains strong.

Shares of listed real estate developers have performed well this year, with Vanke up 10.2 percent year-to-date, and shares of Gemdale, another major developer, up 19.4 percent.

Currently, the most-recommended property developers listed on the A-shares stock exchanges are Vanke, Poly Real Estate, Lushang Property, and Zhongnan Construction.

Shenzhen-listed Vanke and Shanghai-listed Poly Real Estate both said that 2011 net profit jumped 32 percent year on year.

Strong growth

Profits for real estate developers should also be relatively strong in 2012, considering how much pressure the industry will be under. Estimated 2012 profit growth for China's four largest domestically listed developers are all over 25 percent, led by Merchants Property at 33 percent.

However, some argue that the stronger sales numbers in February were largely due to seasonal factors and concerns prices would rise if policies are loosened. If it becomes clear that policies will remain in place, some of the recovery we have started to see could slow as buyers sit on their money in expectations of further price declines.

CapitalVue specializes in providing China-related capital market, fundamental, and time-series statistical databases.