Sort out social security financing

- By Grayson Clarke

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, March 12, 2012

E-mail China Daily, March 12, 2012

For the second year in a row, social security topped netizens' concerns ahead of the annual sessions of the National People's Congress and the Chinese People's Political Consulative Conference. No wonder. With the world economy threatening to take a serious and prolonged downturn, many Chinese are for the first time beginning to take a hard look at what they may be entitled to if tough times do come.

That they are taking such an interest is in a real sense, a tribute to the government's hard work and commitment to extending the social security net. More than 1.1 billion Chinese people are now covered by at least one of the nine main schemes. Great efforts have been made to extend protection to the rural population and self-employed urban population through low cost pension and medical insurance schemes.

The recent restrictions on house purchases for non-residents in a number of cities such as Beijing, linking entitlement to having full social security records for a five year period, has also created more interest in social security entitlements and responsibilities.

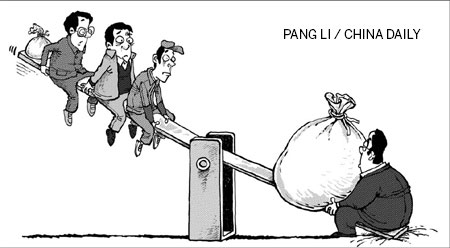

But there are also concerns. One long-standing gripe has been the different and far higher levels of pensions paid to civil and public servants compared to enterprise workers in the main enterprise scheme. This discrepancy is getting worse as the number of retirees every year is growing fast dragging down the average replacement rate - the proportion of the wage replaced by the pension - in the main scheme. And there are concerns over the impact of inflation on pensioners. The past three years have seen particularly high food inflation which tends to have a disproportionate impact on pensioners more limited incomes. Important issues remain over how indexing arrangements for pensions in payment can best reflect the true needs of pensioners.

Finally there are legitimate concerns about whether local governments faced with declining revenues from the property market, can provide additional tax-financed support to maintain pensioner incomes in real terms; or, even worse, whether some may be able to make ends meet at all. Even in the good times there have been poor municipalities which have not been able to pay their promised rate of unemployment benefit. The current downturn will undoubtedly make this situation worse.

In these challenging circumstances, and in particular facing the likelihood of unprecedented demand for social security, the government may be forgiven for not wanting to rock the boat too much or enter into expensive commitments it may not be able to support. But the present situation only increases the importance of implementing long-standing structural changes in the way social security finances are run. The most important of these is raising the "pooling" level of social security at which social security is managed and invested, to provincial level. At present with a few exceptions, most provinces manage funds at the municipal or county level, with limited adjustments between surplus and deficit funds to prevent financial difficulties in the smaller less stable funds. But in the long run this will only perpetuate and increase differences in entitlements depending on where you live. Worse than this it also increases the cost to the taxpayer of social security because the poorer localities get additional subsidies from central and local budgets instead of the revenues that come to the system but which are held by richer localities in reserve.

These large surplus balances are usually idle balances earning very little interest; it is estimated that 80 percent of all locally held social security balances earn no more than a current account deposit rate. In the context of the high inflation of the past two years this represents a real-term decline in value of 10 percent or more. Recently a number of senior figures both from industry and academia have put forward proposals to invest social security funds in stock markets and other channels in order to increase the accumulation rate and also to support equity markets in a period of strong volatility.

But there are risks attached to this. At the moment there is no capacity in provincial level governments to manage a more diversified asset portfolio. And while supporting capital markets is a legitimate objective, it is secondary to ensuring that funds are used and managed in the long-term interests of the participants.

However, given the impact of inflation, not doing anything is certainly not riskless either, and there are sensible limitations that can be put in place on how much and where funds are invested. The Enterprise Annuity Regulations for company pensions would represent a useful starting point and China's sovereign wealth funds including the National Social Security Fund now have significant expertise they can share with new provincial investment funds. While the stock market remains volatile - the Shanghai index is at less than a third of its October 2007 peak - now may be a good chance to buy equities cheaply and generate some good returns as the economy picks up.

The issue of narrowing the differentials for government employees and enterprise workers remains an outstanding issue, which probably requires a big push to broaden the scope, range and take-up of company pensions. But sorting out social security financing first would be a big step forward.

The author is an international financial consultant based in Kuala Lumpur and former fund management expert on the EU-China Social Security Project.