Euro crisis: risk and opportunity

- By Didier Cossin

0 Comment(s)

0 Comment(s) Print

Print E-mail

China Daily, January 9, 2012

E-mail

China Daily, January 9, 2012

|

|

|

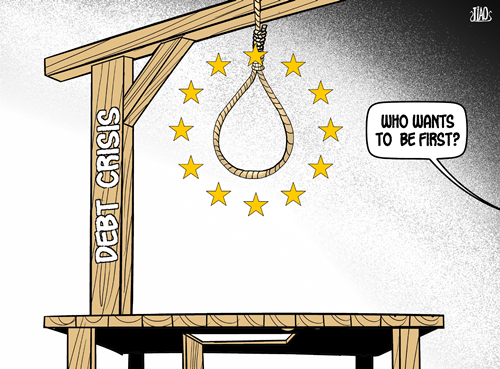

United we fall [By Jiao Haiyang/China.org.cn] |

This year sees the 10th anniversary of the birth of the euro. It will not be peaceful anniversary despite the fact the euro has become the most circulated currency and the second most traded currency in the world. Today, many central banks around the world and many corporations as well, are preparing for a break-up, or at least a transformation of the euro. Indeed, some Central Banks are already checking their ability to print their pre-euro currencies. Ireland, for instance, has acknowledged it is doing this and many are assessing Greece's capability to do so.

The euro crisis threatens the economic health of Europe in unprecedented ways and is one of the great risks of the world today. But as with all great risks there are also great opportunities. Any risk, well assessed and properly managed, represents a new opportunity. China has been in the front row of this investment strategy. And whether China will be as successful as it could be will depend not on luck, but on sophistication.

Europe is vastly diverse and includes some of the safest countries in the world - Norway, Switzerland - as well as some of the riskiest economically - Greece, Ireland, Portugal. The investments considered in Europe thus range from some of the safest in the world to some of the riskiest. It is also good to remember that there is a strong behavioral bias to risk perception. Europe is in the media spotlight and at the forefront of investor concerns. This leads to a herd mentality that confuses the overall European environment. Ultra-safe investments may thus not be considered as such, while some risky environments, for example in countries implicitly or explicitly pegged to the euro, may not be perceived as such. A strong independent risk analysis is thus the first step to ensuring good investments.

While much attention is being paid to the euro itself within the crisis, risk identification should go much further than the currency or the general economy level: the euro crisis may threaten product demand, work continuity from suppliers, specific commodity prices, employment stability and social peace. Disruption in logistics can threaten an investment at least as much as the currency or the economic environment. And thus a thorough identification of the risks concerned is essential to strong investments.

There are three potential scenarios to the euro break-up. The first and most probable scenario consists in peripheral countries, such as Greece, Ireland and Portugal, leaving the eurozone because of the fiscal discipline required to remain in. This would actually lead to a strengthening of the euro in the long term, as the countries leaving the euro would be the weaker ones. Indeed, the requirement for stronger fiscal discipline and the supervision of the IMF for some countries has reinforced the view that a stronger Europe could emerge from the crisis. Part of the risk assessment then is to analyze countries that might potentially leave the euro: Italy? Spain? The second scenario consists of strong countries leaving the euro. A disagreement between France and Germany, or simply the lack of consensus building behind the stronger economies could lead to this lower probability scenario. The euro would then come out weaker in both the short and long term, and the European economic impact would be important in the medium to long term. The third potential scenario would be the general break-up of the eurozone and then perhaps the emergence of some regional currency associations.

In all three scenarios, checking the investment cash-flow safety, the exposure, and which ones can be hedged, are part of the necessary management techniques to develop. Many corporations are already committed to this work, including dollar-denominated ones, and analyzing risk levels before and after risk management implementation.

A natural follow-up to the risk analysis takes us to the second step: pricing and the structuring of the investments. No investment is a good investment when it is at the wrong price. Pricing is thus essential to investment success and is often a signal of how disciplined the bidder is, itself a strong indicator of the quality of the investment strategy. Sophisticated pricing will include both financial techniques, including methods such as option pricing or statistical analysis, as well as behavioral techniques, checking the confidence or optimistic bias of the bidder.

Last but not least, investment management is essential to management success. This is an essential step. Most acquisitions fail not because the deal did not make sense, but because it was poorly managed, sometimes poorly integrated. The principles of successful integration and the skills required for integration management are better understood but cases differ widely. Many investments are too quickly considered as passive investments. Investment governance plays an essential role, and too often a failing role.

The author is the director of the Global Board Center at the International Institute for Management Development, Lausanne, Switzerland.