The new international financial crisis and China

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, August 9, 2011

E-mail

China.org.cn, August 9, 2011

Standard and Poor's downgrading of the US's credit rating is just one feature of the second financial earthquake in three years to shake the world economy. More powerful than the rating agency's actions are Europe's widening debt crises, weak US economic recovery, and severe international share price falls. Why has another crisis appeared so quickly after 2008's financial downturn?

The crisis reappeared for a simple reason: None of the solutions the U.S. and Europe used to tackle the previous crisis addressed its underlying problems. The 2008 financial crash was due to the unsustainable build-up of U.S. debt in the private sector. By the peak of the U.S. economic expansion, in the 4th quarter of 2007, U.S. household and non-financial company debt was 168 percent of GDP – compared to a U.S. government debt of 51 percent of GDP. Given this debt burden, interest rate increases introduced in 2008 to deal with inflation created an inability to repay. The U.S. sub-prime mortgage crisis was not the cause of the financial crash but simply the weakest link in an overall excessive U.S. private debt.

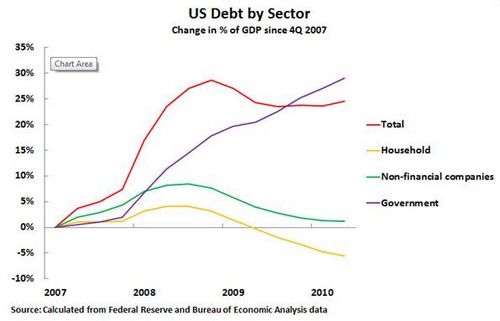

But following the onset of the U.S. economic downturn in 2008, the overall U.S. debt burden actually rose, reaching a peak 247 percent of GDP in the 3rd quarter of 2009. This reflected a fall in GDP as well as debt buildup itself. Since then U.S. debt has fallen marginally to 243 percent of GDP – still 26 percentage points above pre-recession levels.

The reason for the U.S. debt expansion is shown in the chart. U.S. private sector debt peaked at 180 percent of GDP in the 2nd quarter of 2009. It has since fallen to 163 percent of GDP – 5 percentage points above its pre-recession level.

But any decline in private sector debt has been almost entirely offset by the increase in government debt created by budget deficits that exceeded 10 percent of GDP. Thus, the U.S. "nationalized" its debt problem – replacing private debt with public debt. The mechanisms for this were the indirect consequences of the financial crisis, with the recession increasing welfare payments and reducing tax receipts and the transfer of funds to the private sector in the bank bailout.