China's real estate syndrome

Why the steamroller will continue

China's financial system should be seen as a source of strength for the Chinese economy, however imperfect it may be, because of its ability to support the financing of infrastructure and other investments needed to sustain rapid growth. That the banking sector is dominated by state-owned banks that can lend at will at low cost certainly has its advantages, and is a prime reason why China's economy may be expected to continue to grow in the 9-10 percent range for the coming decade and beyond.

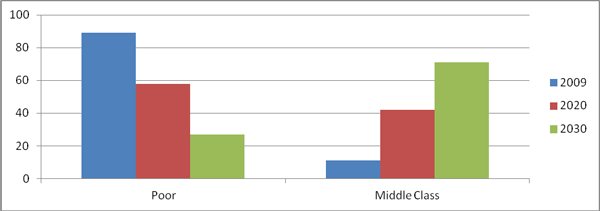

Another reason is that China's population is becoming wealthier – and not just in the country's coastal cities. A 2010 report by the Brookings Institution says that China's middle class is poised to rise significantly not only because of the country's economic growth rate, but because more Chinese are continuing to break out of the ranks of poor. It is estimated that consumer driven domestic consumption will account for up to 50 percent of GDP by 2015, up from 33 percent last year. That is a guarantee of high growth going forward.

Projection of China's Poor and Middle Class (2009-2030)

What all this boils down to is that there is every reason to believe that a combination of government economic control, a high degree of liquidity, rising incomes and consumer spending, and the government's ongoing ability to tap on the brakes whenever the economy gets too hot should mean that the housing bubble that has developed is unlikely to burst any time soon. If it does, it can be controlled more meaningfully in China than in most other countries. The doomsayers and pessimists have been wrong every time they have predicted the Chinese economy's imminent demise. They will continue to be wrong.

Daniel Wagner is Managing Director of Country Risk Solutions, a political and economic risk consulting firm based in Connecticut.

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn

0

0