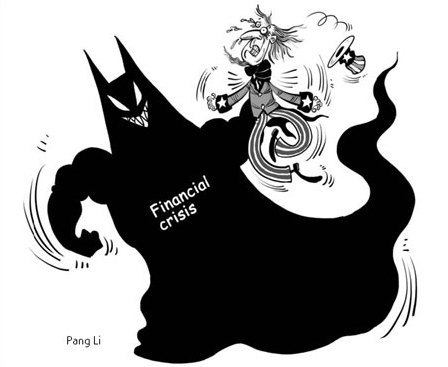

The worsening US subprime crisis has turned in to the "financial hurricane of the century" that is wreaking havoc on Wall Street.

On Monday, the Lehman Brothers filed for bankruptcy, Merrill Lynch was sold to Bank of America. The US government has agreed to provide a $85 billion emergency loan to rescue the huge insurer American International Group (AIG). The three "bomb blasts" rocked Wall Street to the core, sending shockwaves through the US economy and very likely the presidential election as well.

On September 14, Bank of America acquired the 94-year-old brokerage Merrill Lynch, the third largest investment bank in the US. On the same day, AIG, once the top insurance company in the world, applied for $40 billion in federal loans to stay afloat through the worst period of the disaster.

However, the heaviest blow so far to financial markets worldwide had to be the collapse of Lehman Brothers, the fourth-ranked investment bank in America.

Founded 158 years ago, Lehman Brothers survived the American Civil War, the two world wars, the Great Depression, the September 11 terrorist attacks and one takeover attempt before this week.

If the venerable investment banks on Wall Street can be described as "cats with nine lives", Lehman Brothers probably had 19.

But that was apparently not enough today, as the 158-year-old business went for bankruptcy protection after languishing in the red for two quarters in a row, and the Korea Development Bank, Barclay's of Britain and Bank of America abandoned their plans to acquire it.

After the three concussion grenades turned the financial market upside down on Monday, the Dow Jones ended the day losing 504 points – the sixth biggest fall in history and the steepest since 9/11.

The Financial Times Index, meanwhile, tumbled nearly 4 percent, while the CAC40 in Paris dropped by 3.78 percent. The oil futures price fell to less than $100 a barrel on the New York Mercantile Exchange as the US dollar nosedived against the euro and Japanese yen after news broke of Lehman Brothers' demise.

Also on that day, the Federal Reserve (Fed) rounded up 10 cross-national banks and securities companies to form a $70 billion stability fund for the financial market as well as providing a safety net for financial institutions threatened by bankruptcy and ensuring market liquidity.

It also relaxed credit conditions for securities brokerages, while the European Central Bank (ECB) and the UK's central bank launched a market rescue plan worth billions of euros. ECB also injected $43 billion into some 30 banks through one-day refinancing operations.

Bank of England provided short-term loans worth about $9 billion to several banks valid for three days, while Japan's central bank governor vowed to maintain market stability with sufficient capital injection whenever necessary and keep a close watch on the effects of the US financial crisis. It had injected $14.4 billion by Tuesday.

Unfortunately the emergency measures by the US, European Union (EU) and Japan can only ease the tension in financial markets temporarily. As the subprime crash is fast turning into a full-blown financial crisis, the financial regulators are now overwhelmed by rising emergencies.

In March, the US government lent JPMorgan Chase $29 billion for taking over troubled investment bank Bear Stearns. Not long after that the federal authorities started providing liquidity assistance to investment banks by allowing them to trade their assets, including bad ones, for treasury bonds with the Fed. The policy used to be available only to regular banks.