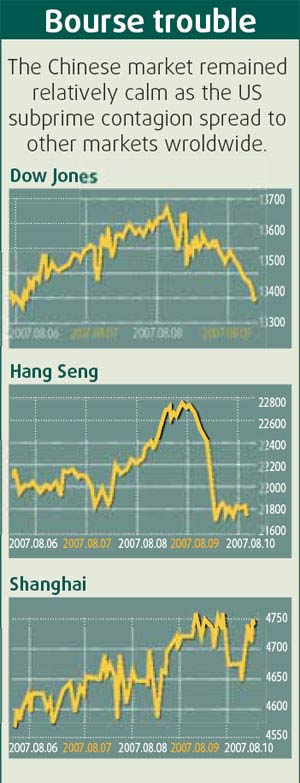

The Chinese market remained relatively calm yesterday as the US subprime contagion spread to other markets in what could be the most serious crisis since the Asian financial turmoil in 1997.

But economists said there are potential risks that the crisis may later have a substantial impact on the Chinese economy.

The A-share Shanghai Composite Index edged down on Friday only by 4.7 points, or 0.1 percent after recovering from mid-session slump.

Asia's other major stock markets the same day fell as much as 4 per cent on concerns about a credit weakness in the US.

The Nikkei 225 index dropped 406.51 points, or 2.37 percent while the Korea Composite Stock Price Index fell 80.19 points, or 4.2 percent.

Hong Kong's blue chip Hang Seng Index shed 639 points, or 2.85 percent. In Singapore and Australia, benchmark indices were also down.

The crisis has spread to Europe, where European Central Bank loaned 94.8 billion euros ($130.2 billion) to banks to ease money shortages as a result of jitters about investments in US mortgages.

The Bank of Japan and the Reserve Bank of Australia followed suit on Friday.

"It seems the US crisis has developed to a stage that is far more serious than expected," Dong Yuping, an economist with the Institute of Finance and Banking of the Chinese Academy of Social Sciences (CASS), said.

Dong said the crisis may not be ultimately stopped until next year and He Fan, from the Institute of World Economics and Politics under the CASS, said it may evolve into the most serious turmoil since the 1997 Asian financial crisis.

Some Chinese companies may have bought the subprime mortgages in the US, which will cause losses, He said.

Bank of China and China Construction Bank, two of the country's "big four" commercial banks, have admitted to being affected by the US crisis. Bank of China said its losses could be several million US dollars.

Some of China's foreign exchange assets may also have been invested in the US mortgage products, said an economist who declined to be named.

He from CASS said the US crisis may drag down the world economy, which would slow down China's exports as well.

Meanwhile, if the US economy slows down, it may lead to decline in prices of oil and other major commodities.

He said this would in turn affect the economic growth of exporters of those commodities, such as Russia and Latin American countries.

"China's exports to those countries would be affected," He said.

As the international credit crunch intensifies, some of the foreign capital, including the so-called "hot money" in China, may leave.

"If the capital exodus triggers market shock, China's financial stability may suffer," He said.

(China Daily August 11, 2007)