Foreign direct investment and migrant workers sending part of their paycheck back home have become more important sources of finance for developing countries than private lending. In 2002 payments on private debt were again larger than new loans, so private debt flows were a net negative for developing countries, according to a new World Bank report, Global Development Finance 2003.

These changes are having profound consequences for developing countries. The boom and bust in private lending was a crucial element in a series of financial crises that started with the 1997-98 East Asia crisis and continued in a new round of Latin American debt problems in 2002. More positively, however, the lower volatility of foreign direct investment (FDI) and remittances is fostering a more stable environment for those developing countries that have learned to live with less external debt.

FDI inflows to East Asia and the Pacific rose to US$57 billion in 2002, up from US$48.9 billion in 2001, as a result of the continuing rise in FDI flows to China. In 2002, China became the largest FDI recipient, surpassing the United States for the first time, by attracting a record high of US$52.7 billion, accounting for 37 percent of the developing countries? total in 2002. Net FDI inflows to the region are expected to increase in 2003-2005 by an average of 10 percent per year.

?The decline in private lending was especially steep in 2001 and 2002 as the global economy struggled through a recession caused by the bursting of the equity market bubble in the major economies,? says Philip Suttle, lead author of the report. ?Debt finance for developing countries has shrunk and won?t come back quickly. Over reliance on debt has been a problem for many countries. Looking ahead there is room for cautious optimism that capital flows to developing countries will be less volatile in the future. This would be good for growth and for poor people.?

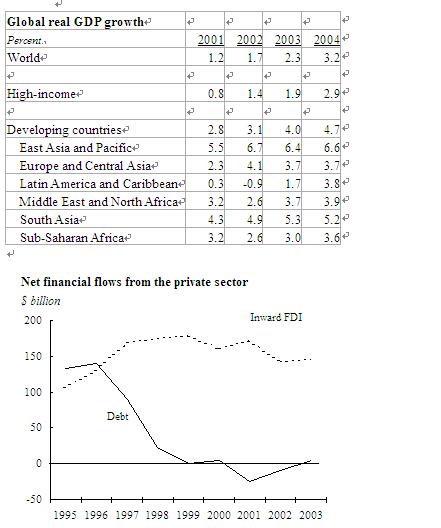

According to the Global Development Finance 2003 report, net private debt flows to developing countries?bonds and bank loans?peaked at about US$135 billion a year in 1995-96 and have since declined steadily, becoming net outflows in most years since 1998. Net debt flows from private sector creditors were negative again in 2002 ? developing countries paid US$9 billion more on old debt than they received in new loans.

Net FDI has slipped from a 1999 peak of US$179 billion to US$143 billion in 2002, and net portfolio equity flows have fallen from US$15 billion in 1999 to US$9 billion in 2002. Nevertheless, equity flows remained the dominant source of external financing for developing countries. In East Asia, net inward FDI flows rose by US$8 billion since 1999 and portfolio equity flows have been small but roughly stable. On the other hand, net debt flows to East Asia were US$8 billion in 2002, and in net terms the region has repaid private creditors a total of US$70 billion since 1999. The rise in equity flows, coupled with declines in external debt, has helped to strengthen East Asian countries? external positions.

Net lending by official creditors to developing countries was positive, at US$16 billion, with another US$32.9 billion provided in grants. Net official debt flows to the East Asia region were negative in 2002 and will likely remain so in 2003, as a few countries made significant repayments to official creditors on loans extended during the 1997-98 crisis. Some of these repayments reflect scheduled maturities; others reflect the desire to prepay.

In April 2002, the Paris Club creditors restructured about US$5.4 billion of Indonesia?s debt service, US$2.3 billion of ODA loans and US$3.1 billion of commercial loans with export credit guarantees.

Still, developing countries overall ran a US$48 billion current account surplus with the rest of the world, up from US$28 billion in 2001, meaning that developing countries continued to be net exporters of capital. The increase was more than accounted for by developments in Latin America, where devaluations and falling imports yielded sharp increases in trade surpluses. East Asia continued to have about a US$43 billion current account surplus, while higher oil prices had divergent effects across other regions.

The decline in debt is being driven in part by investors? preferences. Banks and bond holders have become more wary of holding debt claims on developing countries, whereas non-financial corporations, while cautious and increasingly sophisticated in their evaluation of individual countries, nonetheless recognize that a growing number of developing countries offer the potential for growth, according to the report.

In East Asia, local currency bond markets have grown considerably in recent years, helped by greater domestic stability. The development of local bond markets also reflects efforts to reduce dependence on foreign-currency debt.

The increased reliance on FDI is generally positive for developing countries, since FDI investors tend to be committed for the long haul and are better able than debt holders to tolerate near-term adversity. Many governments that previously borrowed abroad are instead borrowing domestically, on shorter maturities. While this reduces their foreign exchange risk, the shorter-term debt increases the risks from local interest rate fluctuations and the reluctance of local investors to roll over exposures at times of stress, the report said.

And while FDI tends to be less volatile then debt, its stability cannot be taken for granted, since both domestic and foreign investment depend on a positive investment climate.

?The shift from debt to equity highlights the importance of developing countries? efforts to foster a sound investment climate,? says Nicholas Stern, World Bank Chief Economist and Senior Vice President for Development Economics. ?Nine-tenths of investment in developing countries comes from domestic sources. But domestic investors? needs for a positive working environment are similar to those of foreign investors. Both seek stable macro conditions, access to global markets, reliable infrastructure, and sound governance, including restraints on bureaucratic harassment and corruption.?

A positive investment climate is also important for effective utilization of workers? remittances. In countries with poor investment climates, remittances are more likely to be spent on just ?getting by? while in countries with good investment climates recipients are more likely to invest in the farms and small and medium enterprises that are key to poverty reduction. ?A positive investment climate is important for the effective utilization of all types of capital flows, including FDI, remittances, aid and debt,? says Stern.

Like FDI, remittances are a more stable source of external finance than debt. Indeed, remittances tend to be counter-cyclical, buffering other shocks, since economic downturns encourage additional workers to migrate abroad and those already abroad increase the amount of money they send to families left behind. For most of the 1990s, remittances have exceeded official development assistance. Recent trends, including tighter restrictions on informal transfers and lower banking fees mean that remittances through the banking system are likely to continue to rise. In 2001, Philippines ranked third among developing country recipients of workers? remittances, amounting US$6.4 billion, 8.9 percent of GDP.

Despite the relative strength of equity flows and remittances, adapting to weak private debt flows poses a challenge for many developing countries that have come to rely on foreign loans. The net US$9 billion that developing countries repaid private-sector creditors in 2002 came on top of a 2001 figure of almost US$25 billion.

While it is likely that the third quarter of 2002 marked the bottom of the current credit cycle, any rebound is likely to be hesitant. Net debt flows to developing countries are likely to be broadly flat in 2003.

More broadly, the short-term growth prospects for developing countries will continue to depend heavily on the outlook for high-income countries, which in turn will be influenced by geopolitical factors.

?In the near term?the next six to eight months?much will depend on factors that are beyond the control of policymakers in developing countries,? says Uri Dadush, Director of the Development Prospects Group. ?Over the medium term, however, the improvements that developing countries make in their policy framework and investment climate can be a powerful force for higher growth and more rapid poverty reduction.?

Some disruptions from military actions in Iraq, including a temporary rise in the oil price, are built into the forecasts, but no severe, lasting dislocations are assumed. Based on these assumptions, growth in rich country GDP is expected to accelerate from 1.4 percent in 2002 to 1.9 percent in 2003, reaching near-term peak rates of 2.9 percent by 2004 before easing to 2.6 percent in 2005.

Growth in developing countries was 3.1 percent in 2002, up by a small 0.3 percentage points from weak 2001 results. Growth was restrained by the lackluster recovery in the rich countries and by financial and political uncertainties in several large emerging markets. World trade grew by a meager 3 percent, while prices for non-oil commodities rose by 5.1 percent. In East Asia, the new round of market liberalization, strong economic growth, and optimism following China?s accession to the WTO contributed to buoyant FDI.

Net debt flows were very weak especially to Latin America, and foreign direct investment, while more resilient than debt, was nonetheless US$29 billion lower in 2002 than in 2001. The price of oil jumped from US$19 to US$28 per barrel over the course of 2002. For oil importers, this rise more than offset gains in agricultural and metals prices. The baseline forecast projects growth in developing countries to accelerate to 4 percent in 2003 and to 4.7 percent in 2004.

Growth performance over the past 18 months has differed substantially across the major regions of the developing world, largely due to differences in domestic conditions. Some highlights:

- China continued to make strong advances in output?some 8 percent during 2002?despite relative stagnation in Japan and volatile U.S. demand. This helped to drive the recovery in East Asia. Together with policy stimulus in other countries, China?s performance lifted the region to growth of 6.7 percent in 2002, up from 5.5 percent in 2001. Average regional growth of more than 6 percent is expected for the next two years, with China increasingly becoming the engine of the regional economy.

- At the other end of the growth spectrum, growth in Latin America and the Caribbean was held down by the government debt default and banking collapse in Argentina, uncertainty about Brazilian elections, worsening conditions in Venezuela, and an associated US$31 billion falloff in financial market flows. GDP dropped by 0.9 percent in the year, a sharp 2.4 percent fall in per capita terms.

- Although slowing growth in the Euro Area cast a pall on the economies of the developing countries linked tightly with it, a sharp recovery of activity in Turkey following its 2001 crisis, together with continued gains in Russia and the CIS countries linked to higher oil prices, buoyed growth in Europe and Central Asia?producing a 4.1 percent rise.

- Continued strength in domestic demand in India propelled South Asia to gains of 4.9 percent, despite disruptions in regional conditions associated with continued tensions around Afghanistan and between India and Pakistan.

- Growth languished in both Sub-Saharan Africa and the Middle East and North Africa, with both regions registering growth rates of 2.6 percent in 2002.

The report explains that the variability in performance across regions masks underlying similarities in the developing world. A truly global business cycle has emerged with the advancing integration of developing countries into global production, trade, and financial flows. Economic conditions in rich countries now tend to be mirrored rapidly in developing countries through enhanced trade links, just-in-time logistics, and stronger financial tie-ups with affiliates and suppliers in middle-income countries.

Financial conditions facing developing countries are expected to be a little less austere in 2003 than in 2001?02. Flows of FDI are projected to rebound slightly, while net flows from private sources should be modestly positive, albeit still quite anemic. As noted, this outlook is based on the assumption of a quick resolution to the situation in Iraq and a significant decline in the oil price as 2003 progresses.

See tables below.

(China.org.cn April 3, 2003)