China's imports of iron ore and crude oil reached record highs in July on the back of strong domestic demand, even as overall trade showed a steeper decline compared to the same period last year.

As imports are likely to grow and commodity prices expected to rise further, China's growing appetite for overseas goods will considerably benefit resource-rich regions such as Latin America, Africa and Australia, experts said.

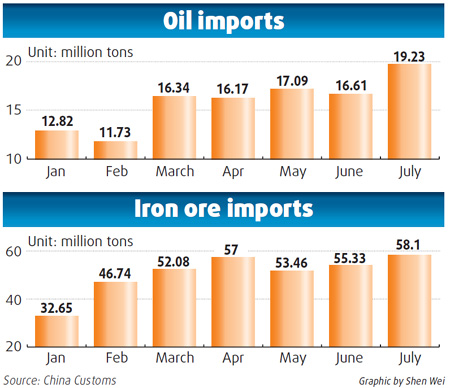

The decline in imports for July was much smaller than exports - 8.1 percentage points lower - as demand for resource-related commodities picked up rapidly. Oil imports climbed by 18 percent to 19.6 million tons from a month ago, and iron ore also rose by 5 percent to 58.1 million tons. China spent a combined $13.8 billion on the two commodities, 15 percent of the total imports.

Overall, China's imports and exports for July decreased 14.9 percent and 23 percent respectively year-on-year, Customs data showed yesterday. Compared with the decrease in June numbers, the declines in imports and exports were deeper in July because of the high base during the same month last year.

However, for the first time this year, exports in July crossed $100 billion in value terms, up 10.4 percent compared with June. Imports also grew by 8.7 percent over the previous month to $94.79 billion.

"If you consider the month-on-month growth (for 2009), China's imports and exports showed strong signs of substantial recovery," said Dong Xian'an, chief analyst from Industrial Securities.

In June, declines in both exports and imports narrowed from a year earlier. "Excluding the high base factor, July figures should have improved. The ease-off trend will continue through the year," Dong predicted.

China's 4-trillion-yuan stimulus package has led to growing consumption of oil and iron at higher prices. Oil is now hovering at $70 per barrel, more than double the level seen in early 2009.

As the world's largest iron ore importer, China's iron ore throughput that domestic ports handled in July surged 35 percent, almost three times the growth of the overall cargo throughput during the same period.

Refiners such as China Petrochemical and Baosteel are stockpiling the commodities in anticipation of rising prices. Rio Tinto, the world's second-largest exporter of iron ore, is witnessing strong demand driven by China and its operations are running "flat out", said Sam Walsh, head of the business.

"Growing demand for the resource-related commodities such as oil and iron ore will assist Chinese imports in getting out of the morass quicker than the exports," said Lian Ping, chief analyst, Bank of Communications.

Lu Junlong, analyst from China Finance Online, a NASDAQ-listed finance group, said "the demand will remain high, and their prices will show a small rise".

And "aluminum will be the next hot import category for China" as the government's efforts at encouraging local consumers to renew or buy household appliances and automobiles take off.

China announced recently it would spend 7 billion yuan for tax rebate programs centering on automobiles and household appliances, in which aluminum is widely used.

From January to July, Chinese imports from Australia suffered the least decline among the top 10 trade partners, said the Customs data. Australia is China's largest iron ore exporter, and in July, imports from Australia were worth $4.16 billion.

"Nations that have rich resources will benefit from China's recovery and imports," said Lu.

According to Standard Chartered, Africa and Latin America were the out-performers, with 67 and 77 percent growth in their exports to China in the second quarter. "Nonetheless, China's continued demand for metals and other commodities will be strongly supportive of its trade links with Africa and Latin America," said Tai Hui, a Standard Chartered analyst.

(China Daily August 12, 2009)