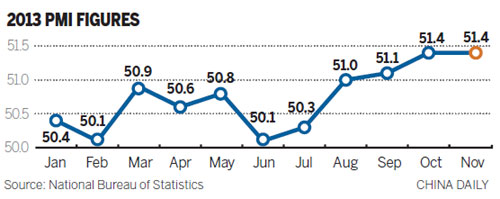

Manufacturing PMI stays at 18-month high

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, December 2, 2013

E-mail China Daily, December 2, 2013

China's manufacturing sector maintained its highest level of output since March 2012 for the second consecutive month in November, as domestic and foreign demand remained steady.

The National Bureau of Statistics released the November manufacturing Purchasing Managers' Index of 51.4, unchanged from October and besting market expectations of 51.1.

Output rose by 0.1 percentage points to 54.5 in November - the fifth straight month of growth - to reach its highest level since May 2012. It was one of the most important factors in the new PMI reading, according to a report from the National Bureau of Statistics.

New orders slipped to 52.3 from 52.5 in October. Export orders increased to 50.6, compared with 50.4 in October, suggesting slight growth in external demand.

Zhao Qinghe, an analyst at the bureau, said that compared with small and medium-sized enterprises, large manufacturing companies contributed heavily to China's rebound in economic growth.

The PMI feature for large manufacturing enterprises climbed to 52.4 in November, 0.1 percentage points higher than in October, to reach its highest level in 19 months. It has remained above 50 for 15 months.

In comparison, the PMI for medium-sized enterprises stayed unchanged from October at 50.2, though the PMI dropped for small factories to 48.3 from 48.5 in October, the fourth straight month that figure has contracted.

"It suggests that the difficult operational situation for small-scale manufacturing businesses has not improved," said Zhao.

Liu Ligang, chief economist at ANZ Banking Group, said that the higher-than-expected PMI shows that overall economic growth is relatively stable and may ensure that the economy's GDP will reach its year-end growth rate target of 7.5 percent.

He said the GDP growth rate for the last quarter may slightly fall to 7.6 percent from the year's peak of 7.8 percent in the third quarter.

"But manufacturing entrepreneurs showed cautious expectations for the development in the near future because some signals indicate that financial market liquidity remained tight. It is likely to raise capital costs and weaken drives to invest," he said.

Wang Tao, chief economist in China at UBS AG, said an "unexpected liquidity squeeze" next year may drive up marginal funding costs because of regulatory tightening of inter-bank lending.

"We expect renminbi lending growth to ease from 14 percent in 2013 to 12 percent in 2014, with total social financing decelerating to a growth rate of 15 to 16 percent," she said.

Wang expected that growth in investments may slow down slightly in 2014. But the good news is that domestic demand should remain largely stable next year, she said.