Beijing's new home sales may hit 16-month high

0 Comment(s)

0 Comment(s) Print

Print E-mail Xinhua, June 1, 2012

E-mail Xinhua, June 1, 2012

|

|

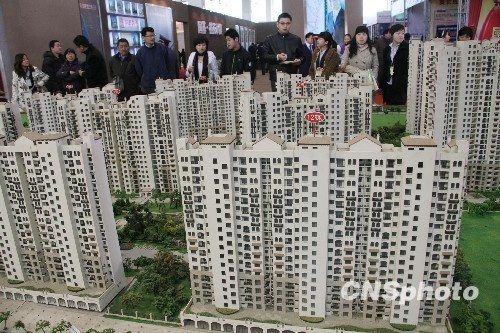

More than 8,500 new apartments were sold in Beijing in the first 26 days of May, up about 25 percent from the same period in April. [Photo/CNS] |

The number of new home sold in Beijing returned to the level before the government's property tightening measures and might hit a 16-month high in May, according to new data.

More than 8,500 new apartments were sold in the city in the first 26 days of May, up about 25 percent from the same period in April, statistics released by the Beijing Municipal Commission of Housing and Urban-rural Development on Thursday have showed.

Meanwhile, sales of second-hand homes increased 18 percent month on month to more than 9,900 units in the same period, up nearly 50 percent from the same period of last year.

Official data showed average price of newly built homes rose 3.8 percent to 20,106 yuan (3,191 U.S. dollars) per square meter from a month ago, according to figures from Centaline Property.

The increase in supply, growing demand and price cuts contributed to the rebound in May, said Zhang Dawei, a chief Centaline analyst.

He said that prospective homeowners might have thought prices were bottoming as intermittent easing policies at the local level have surfaced despite the central government's property curbs.

China started adopting tough measures to calm property prices in 2010. They have included tighter lending policies, higher down payments, a ban on third-home purchases, property tax trials and the construction of low-income housing.

Just when the country's prospective homeowners were beginning to expect wider price drops, intermittent easing policies at the local level -- for example, a reimbursement policy for new home buyers in the eastern city of Yangzhou -- fueled widespread predictions of loosening controls nationwide.

For the rest of 2012, however, it is too early to judge the trend as market demand may shrink after the recent blowout and more fine-tuning policies at local levels will increase uncertainties, said Hu Jinghui, vice-president of 5i5j Real Estate.