China 'wealth exodus' underestimated

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, March 17, 2012

E-mail China Daily, March 17, 2012

US a top destination

Despite its risks, the US investor immigration program remains a popular choice for wealthy Chinese.

A total of 2,969 Chinese people applied for the EB-5 visa in the fiscal year 2011, accounting for three-fourths of total applicants, according to figures released by the United States Citizenship and Immigration Services. Although many are still awaiting a decision, 934 permanent residencies have been granted.

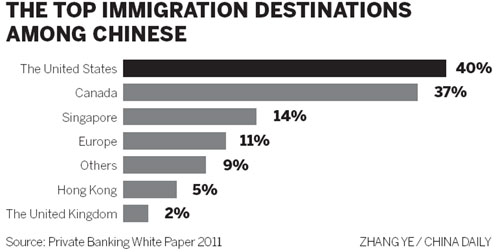

The US is the top emigration destination, followed by Canada, Singapore and Europe, according to a joint survey by Bank of China Ltd and the Hurun Report last year. The report found that 60 percent of about 960,000 Chinese with assets of more than 10 million yuan were either thinking about emigrating or taking steps to do so.

Australia, another popular destination, requires foreigners to apply for a provisional visa before applying for permanent residency four years later. There are various visa types under the "Business Skills visas" system, which allows overseas investors, senior executives and entrepreneurial talents to settle in Australia by developing businesses in the country.

For example, the 890/892 visa allows provisional visa holders to obtain residency if they have had an ownership interest in a business in Australia for at least two years, with significant personal and business asset turnover.

Applicants for the "Business Skills visas" from China totaled more than 9,000 last year, nine times the number from South Korea, the second-largest group, according to the Australian immigration authority.

Kevin Stanley, executive director of global real estate consultancy CBRE Group Inc, said it has seen very strong interest from Chinese individuals looking to buy apartments, predominantly for family use and particularly in connection with children studying in Australia.

Chris Bevan, a real estate agent in Melbourne, said that his recent sales to buyers from Shanghai ranged from two bedroom apartments priced at A$300,000 ($314,000) to a luxury beachfront home for A$18 million.

Strong demand from Chinese buyers has already pushed up real estate price worldwide. Investors from the Chinese mainland account for between 20 and 40 percent of foreign property investors in Vancouver, Toronto, London and Singapore, according to a report from the real-estate consultancy Colliers International on Feb 28. In Vancouver, the property price has been pushed 9 percent higher in the last year, because of Chinese investors.

Reaction

People in industries related to the boom, such as the property market and emigration advisory services, have welcomed the trend. Bevan said that Chinese and other foreign investors have helped Australia continue to grow in a market that has seen an international downturn in the last 12 months.

Local residents interviewed by China Daily approved of the development.

John Harper, a town planner in Melbourne, said the total number of Chinese immigrants contributing to population growth in the city was somewhere between 3 to 4 percent.

"I doubt that figure would create a significant impact on house prices," he said.

"You never hear about New Zealand or British immigrants pushing up housing prices. These two groups make up about 30 percent of people moving to Australia, or three times the number of Chinese, I guess," he said.

"I don't really mind the 'influx' of Chinese going for permanent residency. I think there are guidelines and controls overseen by the Australian government," said Jeremy Lam, a financial analyst in Australia. "And these rules and regulations are gradually becoming more and more stringent over time."

But back in China, the news of the wealth exodus has sparked mixed sentiment.

"Nobody in the world can ever stop China's property speculators," according to a sarcastic post from one netizen on the micro blog Sina Weibo.

Some netizens have blamed the domestic cap on property sales imposed by the Chinese government for the overseas purchasing spree.

Chinese experts warn that talent is flowing out with wealth, which is a more worrying trend.

"If this trend continues it will not only hurt the Chinese economy in the long run, but also prevent it from building an 'olive-shaped' society with a large middle class, because a great proportion of the emigrants are middle-class professionals," said Zhang Monan, an economic researcher with the State Information Center.

|

|