Local govt debt poses threat to economy

0 Comment(s)

0 Comment(s) Print

Print E-mail

China Daily, January 11, 2012

E-mail

China Daily, January 11, 2012

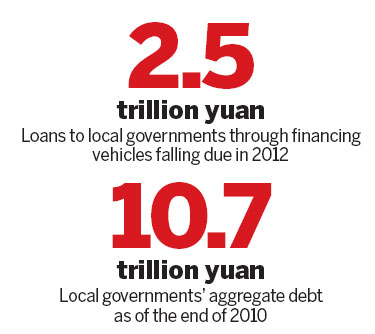

Loans to local governments through financing vehicles will be a major threat to China's economy, with up to 2.5 trillion yuan ($396 billion) in debt falling due in 2012, even though the authorities are easing liquidity, analysts said.

He Zhicheng, chief economist at the Agricultural Bank of China Ltd, said that lenders are already under pressure from non-performing loans (NPLs) as this debt matures, and the central government must take concrete steps to solve the problem.

"The banks are waiting for new policies, probably extending the tenure of the loans. The government must do something to resolve loans that probably would default," he said, adding that such loans are "absolutely dangerous".

More 2.4 trillion yuan must be repaid this year, including some 100 billion yuan in interest, said Oliver Chiu, assistant vice-president and head of research and investment advisory in the wealth management unit of Citibank (China) Co Ltd.

But he said these payments would not be a major problem because questionable debts could be restructured and more local governments would be allowed to sell bonds directly.

Further, a pilot property tax program "will be broadened to other regions from Shanghai and Chongqing in 2012, to guarantee local governments' fiscal revenue, which would be affected by declining land sales", he said.

Chiu said it wasn't likely that the loan maturities would be extended because the government realizes doing so would increase the risks and ultimately worsen the problem.

Local governments had aggregate debt of 10.7 trillion yuan as of the end of 2010, the nation's top auditor said last June.

Of this total, local governments have an obligation to repay 6.7 trillion yuan, or more than 62 percent of the total debt. In addition, they underwrote loans of 2.3 trillion yuan, nearly 22 percent of the total debt.

Moody's Investors Service Inc has estimated that the Chinese banking system's NPLs could reach 8 to 12 percent of total loans, and it said that banks' exposure to local government borrowers was greater than it had anticipated.

These debts assumed through financing vehicles are "generally safe and controllable", Premier Wen Jiabao said on Saturday at the end of the two-day National Financial Work Conference in Beijing.

But he said that these financing vehicles' revenue and expenditure should be consolidated into government budgets, and he called for the establishment of a mechanism to control gross local government debts.

Concerns have risen that local government debt could destabilize China's financial system and hurt the economy if not managed properly, especially given the central government's moves to clamp down on the property market and tighten liquidity last year.

To ensure adequate liquidity for the world's second-largest economy and minimize debt default risks, commercial banks will have to lend at least 1 trillion yuan more this year than in 2011, regardless of how many times the central bank changes the required- reserve ratio (RRR) for lenders, said He.

New yuan-denominated loans last year reached 7.47 trillion yuan, according to data released by the central bank on Sunday.

China still has room to cut the RRR by as many as eight times in 2012. Meanwhile, GDP growth this year will slow to 8.4 percent from about 9.1 percent in 2011, said Chiu.

But he ruled out any cut in interest rates. "On the contrary, China could even raise interest rates this year to facilitate economic restructuring, as current interest rates still lag behind the inflation rate," he noted.

"The local debt problem will not be resolved within the next two to three years, but allowing more liquidity will definitely help ease the pressure on local authorities," said Fan Mingtai, a researcher with the Chinese Academy of Social Sciences, a government think tank.

A more relaxed environment would revive credit-starved companies, and a business rebound would generate more tax revenues to offset local governments' debt-repayment ability, which has been damaged by shrinking land revenues, Fan said.