Steer clear of US debt, expert warns

|

|

|

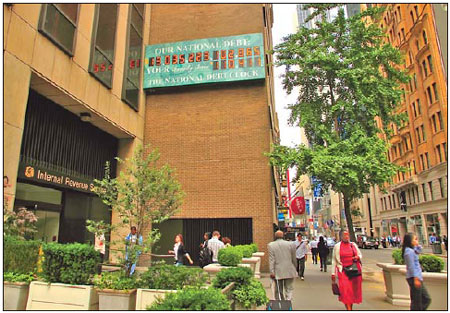

The debt clock near Times Square in New York shows the US owes its creditors $13 trillion. A former adviser to the Chinese central bank has urged the largest foreign holder of US treasuries to stop buying the "risky" assets. [China Daily] |

China, the largest US creditor, should stop buying US Treasuries because the "cost" of lending to a nation that may face a default on its debt is too high, said former Chinese central bank adviser Yu Yongding.

The US may reach its congressionally-mandated debt limit of $14.3 trillion in a few months, which could lead to a default, Yu said on Thursday. If the US were a euro-zone nation, a default or bailout would have happened long ago, said Yu, who is president of the China Society of World Economics and a former adviser to the People's Bank of China.

"China has kept on lending money to the US to keep its export machine going, and to prevent losses" on its holdings of Treasuries, said Yu. "Perhaps it is too late to do anything about the existing stock without causing a serious political and financial backlash. But at least China should stop continuing building up its holdings."

Experts including the current Chinese central bank adviser Li Daokui have urged diversification of the nation's foreign exchange reserves away from US debt after the country's holdings of Treasuries rose to a record $1.175 trillion in October. Pacific Investment Management Co dumped all Treasuries from its $237 billion Total Return Fund, the world's biggest bond fund, last month as the US projected record deficits.

China wants to diversify investments made with its $2.8 trillion of foreign exchange reserves to include equity in the world's largest companies and into non-traditional currencies including the Russian rouble, Indian rupee and Brazilian real, said Li, an academic member of the People's Bank of China's monetary policy board. Diversifying away from dollar assets too quickly may "disturb the market" and make China a "victim", Li said at a briefing in Beijing on Thursday.

China, the largest investor in US government debt after the US Federal Reserve, or Fed, held $1.145 trillion of longer-term notes and bonds in December, the most-recent Treasury data show. That's a decline from October and an increase of 39 percent from a year earlier.

China's stake in bills in December declined 78 percent to $15.4 billion, Treasury data show.

The nation bought more US bonds even as its leaders criticized Fed Chairman Ben Bernanke's plan to buy $600 billion of Treasuries by June. Jesse Wang, executive vice president of China Investment Corp, the country's $300 billion sovereign wealth fund, said Jan 15 that devoting too much of its reserves to US assets such as Treasuries was too risky.

China should accumulate reserves of rare earths, used to make hybrid cars and iPods, rather than buy US debt because the returns would be better, Wang Zhan, a member of the Chinese People's Political Consultative Conference, said on Thursday.

0

0